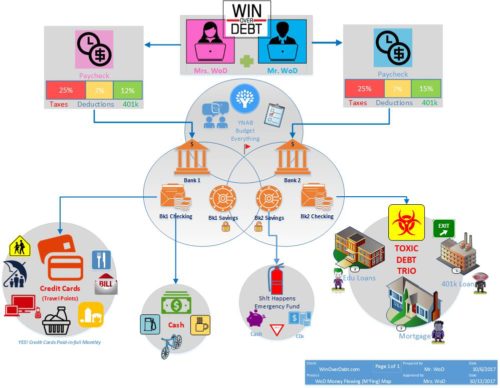

The Money Flowing Map (WoD M’Fing Map)

New Blogger JC (Señor WoD) here, mesmerized with all the personal finance blogger money maps currently flowing in cyberspace. I’m amaze on the various ways bloggers are documenting their personal flow of money, via their own unique paths and styles, but with similar ends in mind. Shout out to Budgets on a Stick, Apathy Ends, and The Luxe Strategist for turning me on to this trend.

I got to amid, prior to these awesome bloggers highlighting money maps, I didn’t see a need for this type of analyst nor had any interested in the value it provides. However, it’s been a while since I let my creative side ‘wild-out like it’s 1999’ in the production of visual graphics that can stimulate my senses (the little I have left). Plus, I just got my hands on new software (grad school perk) that I had been itching to try. Self-indulgence is a hell of a drug and a great motive for learning something new. This seemed like the perfect time to put Microsoft Visio, a diagramming and vector graphics application, to the test, so I gave it a shot.

Prior to engaging this creative assignment, I had a skew outlook on how our money shuffle around my financial (lack-of) balance sheets.

My personal mental map of our familia’s money flow chart was more “Dora the Explorer’s Vamonos Amigos!” scenic valley tour than “Jumanji’s Every month at the quarter moon, the wisp will clear your lagoon” treacherous trails.

My mind was envisioning Lucky Charms Magically Delicious Pot o’ Gold dreams instead of Tough Mudder f*ing painful reality.

I figured I can easily breakdown how my dinero flows in an hour or so straight from the dome. Foolish boy indeed! This financial rabbit hole runs deep, cavernous with many twist, turns and dead ends. What a chump am I to think I know anything about my own money?

Well, 10-hours later and (more than) a few rounds of Cuba Libre, I think I got something. Hopefully something worth reviewing by all yous (maybe enlightening, maybe not).

The WinOverDebt.com Money Flowing Map (WoD M’Fing Map) Breakdown.

(I tried to keep it ‘somewhat’ simple to understands, hopefully it works)

BUDGET Everything!

Leading off, Mrs. & Mr. WoD (WinOverDebt) do not survive without YNAB! We budget everything daily and reconcile bi-weekly. We have been proud YNAB’ers for over 2-years now and can fairly attribute a lot of our current stability (working towards FI Success) to the fundamental culture change YNAB “Give Every Dollar a Job” budgeting requires. I’m sure many people don’t like to deal with manual entry systems, but we prefer it since it enables us to stay connected to every dollar expended and saved. We have tried Mint in the past, but it was too passive (automated) so it did not work for our style of money management.

PAYCHECKS

The two of us work in professional careers that pay us justly for our knowledge and experience. Gratefully, our efforts have not gone unnoticed, we both received generous salary increases within the last year. All our new-found job money is earmarked explicitly to the decimation of debt, no budget creep allowed, no excuses. We have the same salary paycheck cycle in place with automated direct deposits distributed into our two checking accounts. Our gross salaries are deducted equally with payroll taxes around 25% and pre-tax deductions of 7% (including family health care). Where we currently differ is in the amount of funds we currently allocated to our 401k retirement plans, Mrs. WoD saves 12% while I save 15%. We hope to push these percentages higher (maybe even max them out) by the end of 2018.

BANKING

Fresh out of a major banking services consolidation that streamlined our account system from 5 to 2 providers. A much-needed restructuring completed over the summer to help us monitor our banking behavior better and maintain our sanity. As we aged (young Gen X’ers, but not enough to be millennials), we more than double the number of operating bank accounts we carried without closure of older ones. This practice quickly became overwhelming for us and negatively promoted our out of control financial downhill death spiral.

Fast forward to today, we are now determined regain control of our finances by simplifying our accounts. We settled on maintaining relationships with only 2 banks, each providing checking and savings accounts, that can work in concert for all our banking needs. Bank 1 Checking is our workhouse that handles the daily and lifestyle expenses, while Bank 2 (Online) Checking manages major monthly expenses like mortgage and education loans. Bank 1 Savings secures our extra cash savings we don’t want to touch (locked One-Way transfer). Bank 2 Savings is more accessible for multi-way transfer between accounts for potential use of emergency (Sh!t Happens) funds and also supports our ladder CDs accounts.

CREDIT CARDS

We lived a life without credit cards for over six years thanks to our debtor’s prison sentence following the crash of 2008. About 18-months ago, we began the process of rebuilding our credit standing with the introduction of a secure credit card (our money). Six months later, we obtained a second secure credit card with a different bank to continue to support our rebuilding plans. Just 3-months ago (as planned), we annexed an AMex travel rewards card to employ travel hack practices for our benefit. We understand this can be a double edge sword, but we have built-up are financial arsenal to support this new strategy. All three credit cards are paid in semi-monthly cycles to maintain proper funding controls. Plus, our money reserves are sufficient to quickly cover any major hurdle that may come our way. The new travel rewards card has become the family workhorse for general and monthly expenses for its generous points accumulating system. The other two cards play a supporting role “as needed” by Mrs. And Mr. WoD, or when the Amex card is passed our utilization comfort zone of 75% of credit line. Remember, we zero it out semi-monthly, so this would only happen upon major purchases.

CASH

Our daily cash fund sustains gas purchases (when cheaper to pay cash than credit) and miscellaneous expenses like recreational activities, bodega (convenience store) buys, and impulse coffee truck stops. It also serves us well for the occasional ice cream and snacks trip for the kids (and me). When purchasing gas, the cheapest option wins, and many fueling locations in our area charge less per gallon for cash over credit. It also comes in handy when splitting the cost of lunch with friend without the need for various credit card processing charges.

SH!T HAPPENS Emergency Fund

The Shit Happens Emergency Fund, rightfully titled, is our reserves fund to combat all unknown (shit Happens) situations that may come our way. Currently, we have enough money in this fund to support about 2-months of expenses, but we are committed to increase it to 4-months by the fourth quarter of 2018. After funding this account with enough money to cover 4-months of expenses, we will reallocate extra resources to wage All-out War on our arch nemesis-es, The Toxic Debt Trio.

TOXIC DEBT

Our Chapter-13 (five-years) Prison Term rendered us financially, physically, and emotional depleted. In the aftermath, our debtor’s burden and financial struggles remain painfully Freakin real as we try to recapture what little fiscal decently we have left (fresh start my a$$). Today, we remain humbling weaken, but not lifeless, and what doesn’t kill us, can made us stronger. Excuse me as I digressed (more on that on another episode), back on topic.

The WinOverDebt familia is laser focus on the annihilation of the repugnant Toxic Debt Trio and their Weapons of Mass De(bt)struction. Beginning with our current battle against Black Manta’s (401k Loans) vicious arsenal of retirement savings draining artillery. Over the past year we made some headway in our debt brawl against Black Manta, but the adversary is resilient, pushing back with all it’s might. Staying strong in this constant fight, calculated victory is in our sight (November 2020, give or take a few months).

Later, we will bring our financial armada to combat the cynical Joker (Education Loans) for filling our young hearts with hopes of a better (educated) future, but instead enslaving us in an institutional nightmare of misery and graduated charges accruing payment plans. Crushing the opponent, our fledgling debt-slashing army shall once again taste victory, prevailing vindicated by years end 2023.

Our greatest toxic debt conquest shall be our last, doing battle with the infamous Bizaro Mortgage Loan and its money sucking infinite interest only hoarders. Since 2005 you have bullied us, month after month, with your fees and interest only seizure of funds. Hopes of white picket fences turned to visions of metal prison bars. Taking more than just our lunch money, leaving us with bloodied, black-eyed, emotionally scarred.

We say, “No Mas!”, the FIRE plan is in motion, and we will escape your torturous clutch by the time the ball drops on the year 2025. Victory will be ours!

The Chain Gang

Current members of the Money Map chain gang.

Co-Anchor: Apathy Ends

Co-Anchor: Budget on a Stick

#1: The Luxe Strategist

#2: Adventure Rich

#3: Minafi

#4: Othalafehu

#5: The Frugal Gene

#6: Working Optional

#7: Our Financial Path

#8: Atypical Life

#9: Eccentric Rich Uncle

#10: Cantankerous Life

#11: The Retirement Manifesto

#12: Debts to Riches

#13: Need2Save

#14: Money Metagame

#15: CYinnovations

#16: I Dream of FIRE

#17: Stupid Debt

#18: Spills Spot

#19: Making Your Money Matter

#20: Life Zemplified

#21: Trail to FI

#22: The Lady in the Black

#23: Smile & Conquer

#24: Her Money Moves

#25: Full Time Finance

#26: Abandoned Cubicle

#27: Freedom is Groovy